Effortlessly manage your practice finances

Become part of the therapist community running their back office on Heard. Our accounting and tax tools empower you to save time each month, gain mastery over your finances, and remain tax-compliant throughout the year.

Book a free consult

We’re loved by thousands of therapists.

Book a consultSave time and money, so you can focus on being a therapist

The less time you spend wrangling finances, the more time you have to help your clients.

Run your therapy practice with confidence

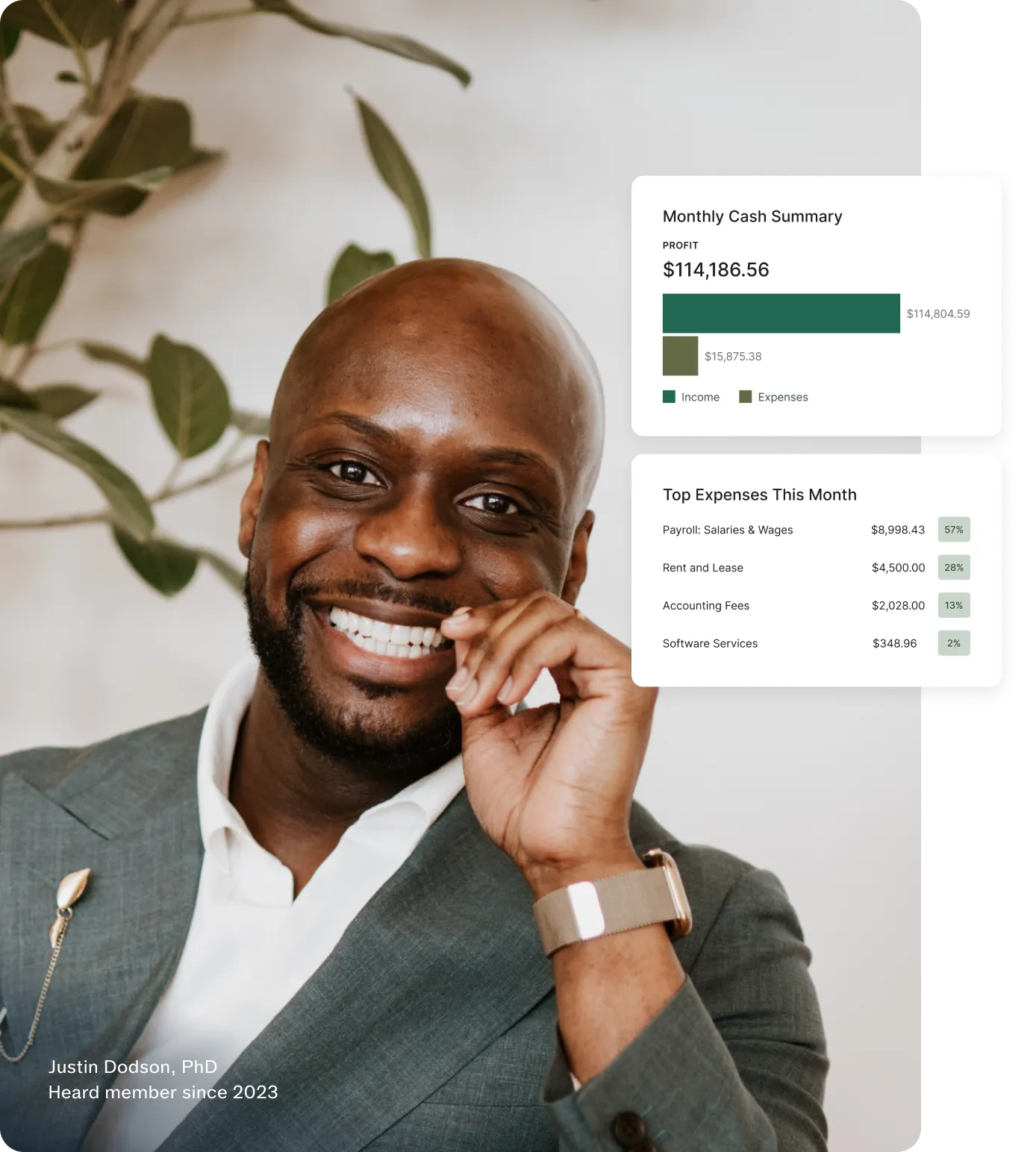

Make informed financial decisions

Determine how much to pay yourself and set aside for taxes each month.

Stay organized

Upload documents and receipts so you’re not scrambling at tax time.

Never miss a tax deadline

Make tax payments on time, every time to avoid IRS penalties.

Grow intentionally

Know when you’re ready to hire employees and grow your practice.

Manage your therapy practice finances, all in one place

*Services provided via preferred partners.

Bookkeeping and reporting

Tax prep and filing

Full-service payroll

S Corp election

Budgeting and tracking

Banking and checking*

Business entity formation*

SEP IRA retirement plan*

Financial support at every step in your journey as a therapist

For new therapy practices

We’ll help you form your business and set up a bank account so you can focus on getting your first client.

For established therapy practices

You’re running your practice but doing it yourself. Ditch the spreadsheets and centralize how you manage your back office.

For expanding therapy practices

Ready to hire other therapists and expand your solo practice into a group practice? We’ll help you elect S corp and set up payroll.

See how it works

Get reminders, reports, and support in a convenient, easy-to-use dashboard.

Got questions? We are here for you!