When starting your private practice, oftentimes the act of finding clients is enough of a battle. Then, the world of small business hits, and you’re suddenly throwing around terms like “entities” and “corporations," when in reality, you just want to see your clients.

We're here to bridge the gap between therapist and small business, and make it a bit more digestible.

One of the most important decisions you’ll make in your journey as a therapist and private practice owner is what your business entity will be—a “sole proprietor” or an “S Corporation." The difference between these two entities comes mainly from how you’ll be taxed.

What's a sole proprietor?

A sole proprietor means that you are the one in control of your private practice. You own it and you personally pay its taxes.

You’ll report any profits on your own personal tax return at the end of the tax year. Here are tax basics for sole proprietor therapists.

What's an S corporation?

An S corporation is a tax designation that is granted by the IRS. To keep things simple, this legally separates your company from you as an individual.

There are also tax benefits. S corporations, like sole proprietors, are pass-through entities. That means that your practice income passes through you as the owner of your S corporation. You don’t have to pay separate taxes on your business. The owner then pays the taxes on the income.

Income passed through to an owner from an S corporation is not subject to self-employment tax. The owner only pays income tax on their business income. Here are tax basics for S corporation therapists.

Tax benefits for S Corporations

Being taxed as an S corporation can provide a variety of other benefits:

- As an owner, you have limited liability as an S corp.

- S corps require you to pay yourself a “reasonable salary." (Sound fun yet?)

- It is easier and less expensive to transfer ownership, were the case to arise.

- You can avoid double taxation on both the corporate shareholder level, unlike many other corporations.

- You can avoid additional self-employment taxes!

{{consult}}

How to switch to an S Corporation

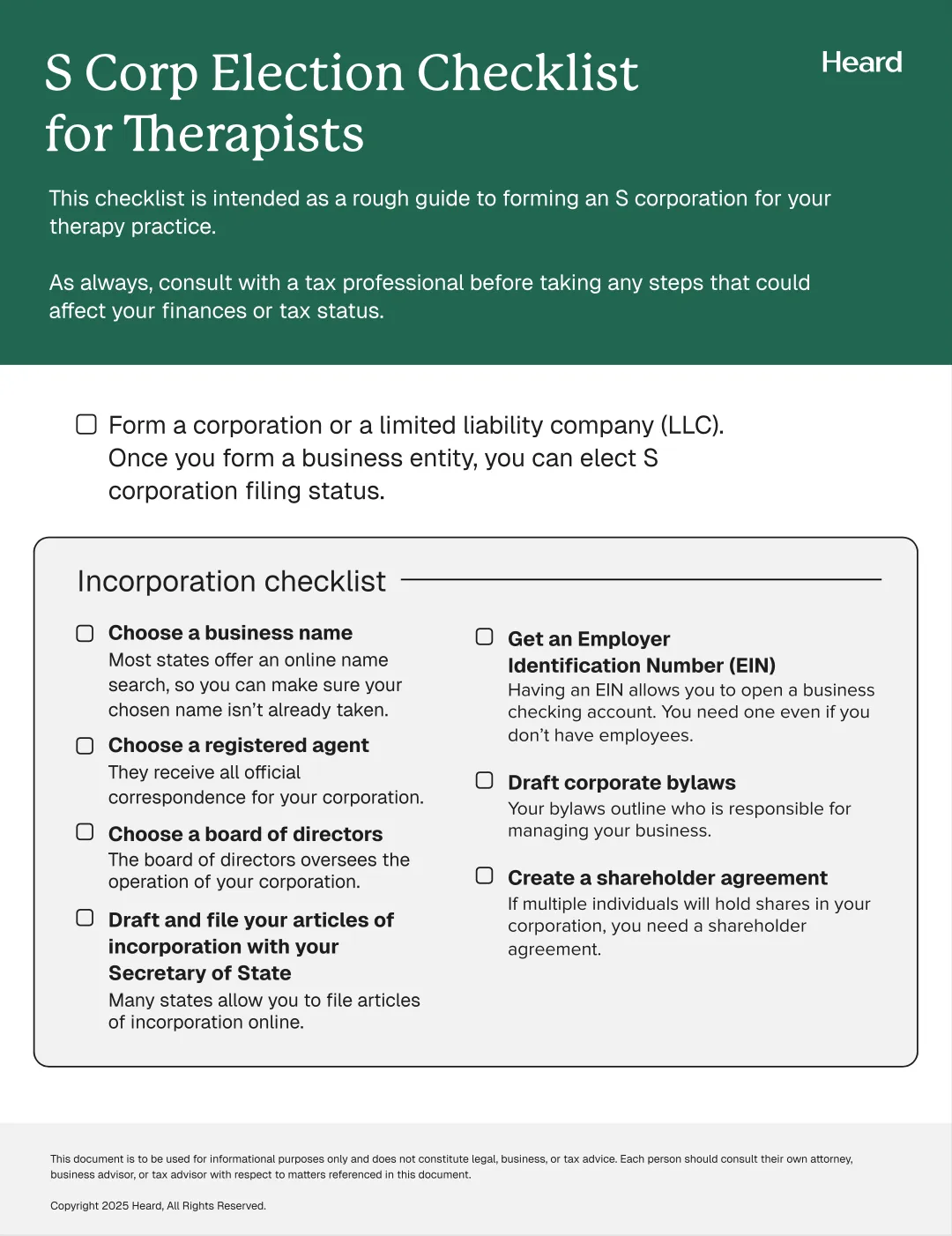

If switching to an S corporation is something you may be interested in, there’s nothing to fear. Converting your business entity may sound difficult, but it is actually fairly easy. The process can take 4 to 6 weeks.

You can do so by following the below steps.

Form a business entity

Before you can elect to be taxed as an S corporation by the IRS, you first need to form a business entity with your state. Most therapists form an LLC. Some states require a PLLC. In California, you must form a professional corporation. Check with your state and city to see if you need to obtain any additional licenses.

Apply for an Employer Identification Number (EIN) from the IRS

This only takes a few minutes, and can be done online!

Fill out and subsequently file IRS Form 2553

If you’re a new business, you need to file Form 2553 within 2 months and 15 days of the date you form your business entity. If you’re an existing business, you must file the form within 2 months and 15 days of the beginning of the year that you want to be treated like an S corp.

There is no filing fee. However, once formed, you will have to make your S corporation election within 2 months and 15 days. This assumes that you meet all the requirements. Each year thereafter, you must file the statement of information and pay the associated fee. Ideally, filing Form 2553 should be done with a tax expert who knows and understands your practice well.

There are perks to filing with S corporation status, but many choose to stick with sole proprietorship due to how easy it is to use. If you are hoping to gain more protection but keep that “pass through entity” side to your business, an S corp is great to look into!

Making these decisions about your business is never easy, and can be especially difficult to stomach on top of your full caseload of clients. Always consult with an attorney or accountant before making complex business changes.

—

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{resource}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.

We’ll tell you when it’s the right time and even file the paperwork for you. Schedule a free consult to learn more.

Schedule a free consult