With the end of the tax year approaching, now is the time to make last-minute purchases and benefit from tax deductions.

But remember: You can only write off deductible expenses. For a complete breakdown, including recent changes to deductions, check out Therapy Practice Tax Deductions for 2025.

Equipment and technology

Any equipment or technology you use in your office is a tax-deductible expense. That includes:

- Computers

- Work phones

- Printers, scanners, and digital signature pads

- Office chairs and therapy couches

- Cameras, microphones, and lighting for telehealth

- Medical-grade HEPA air purifiers

Practice management tools and software

If you pay a monthly fee for software or SaaS, consider switching to an annual payment plan and purchasing it before the end of the year. Provided you use cash basis accounting, you can write off the expense in the current year.

Some examples:

- Heard

- EHR or EMR

- Telehealth platforms

- HIPAA-compliant email

- Scheduling and billing software

- Password management tools

Office improvements and furniture

Ordinary necessary office improvements are tax deductible. Keep in mind, these should be changes you make so your office can keep function up to standard. Installing an in-wall aquarium in your waiting room won’t meet the IRS’s definition of ordinary and necessary.

Furniture purchases should follow the same guidelines. Waiting room chairs are ordinary and necessary. A spa-grade massage chair is not.

Some examples:

- Fresh painting, lighting fixtures, and decor

- Soundproofing and acoustic panels

- White boards and bulletin boards

- Wall-mounted displays

- Desks and ergonomic equipment

- Accessibility aids like grip bars and ramps

Professional development

Purchases you make to meet continuing education requirements, upgrade your skills, or maintain professional memberships are tax deductible.

That includes:

- Training modules, workshops, and online courses

- Conference tickets

- Registration and renewal fees for professional organizations

Clinical books and therapeutic tools

This is a good time to purchase books and therapy tools you will use in the year ahead, such as:

- Diagnostic tools (eg. assessment forms)

- Reference books for clinical practice

- Treatment manuals

- Workbooks (eg. for CBT)

- Flashcards

- Play therapy tools

- Sand trays

- Art therapy supplies

- Weighted blankets and white noise machines

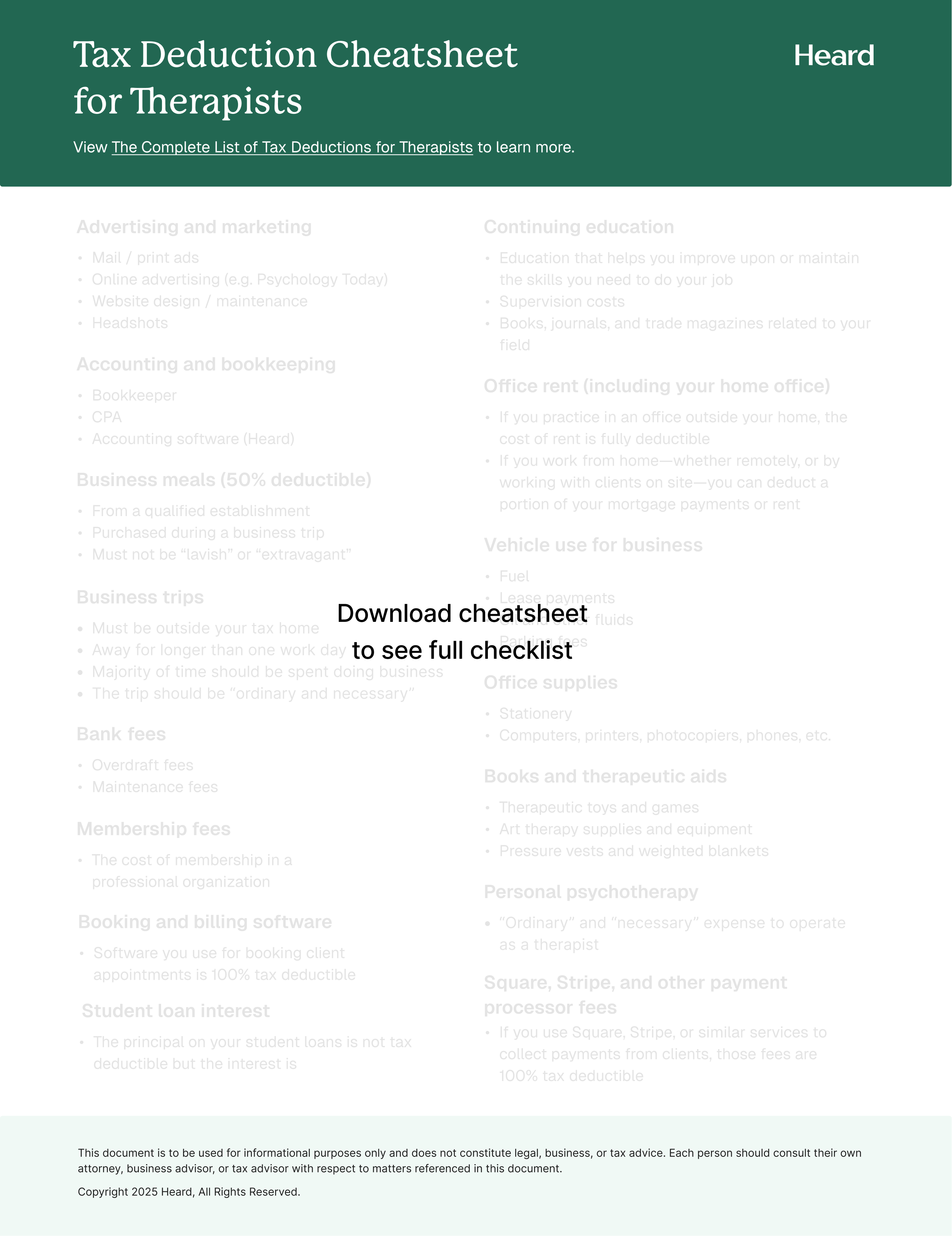

{{resource}}

Marketing upgrades

If it’s time to give your marketing a boost, you can plan ahead for changes next year while making some purchases now.

Some examples:

- Website redesign

- New listings in therapist directories

- Credits for online advertising

- Annual registration for email marketing or SEO tools

- Annual registration for business social media accounts

- New branding assets (eg. logo design)

- Professional consultations

Supplies

Even the consumables you use day-to-day in your office can add up to a sizable tax deduction if you stock up in advance.

Consider making bulk purchases of:

- Office supplies (eg. printer paper, ink/toner)

- Cleaning supplies and equipment

- Tissues and hand sanitizer

- Notebooks and pens

- Tea, coffee, or other beverages you offer clients

Retirement and health plan contributions

Particularly if your earnings for the year are higher than projected, making contributions to retirement funds and health plans can reduce your tax burden while helping you to grow your nest egg or prepare from unanticipated expenses.

That could include:

- Contributions to a health savings account (HSA)

- Solo 401(k) contributions

- SEP-IRA contributions

- Group 401(k) contributions (if you have employees)

- Defined benefit plan funding

Mileage and vehicle-related deductions

The majority of therapists are limited in what they can deduct from their taxes as vehicle expenses. Travel to and from your office does not count as business use as a vehicle, so unless you regularly drive outside of the town or city where you practice, it’s unlikely that you will be able to take advantage of this deduction.

However, if you do use your vehicle for work—for instance, to travel to a clinic where you have a temporary contract, or to treat clients in their homes—then you can leverage the vehicle use deduction to write a few extra dollars off your tax return.

If you use the mileage-rate basis, catching up on travel logs now can ensure you benefit from every mile you traveled during the year when you claim your deduction.

On the other hand, if you write off a percentage of your vehicle expenses as a deduction, making necessary purchases—mainenance, repairs, new tires, oil, and even window washer fluid—can give your deduction a boost before the year ends.

—

If this is your first time writing off business expenses as a self-employed therapists, or if you’re looking for a quick refresher and news about the latest changes to business deductions, check out our Complete Guide to Tax Deductions for Therapists.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{cta}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.