Confronting the finances of your business can be scary for many therapists, especially when you are starting a private practice and cash flow is limited.

Your expenses can financially seem insurmountable. You could even begin to question if starting your own private practice was the right decision (hint: we almost guarantee it is).

To remedy this logical fear, here are some ideas for overcoming common barriers that prevent mental health practitioners from achieving financial freedom.

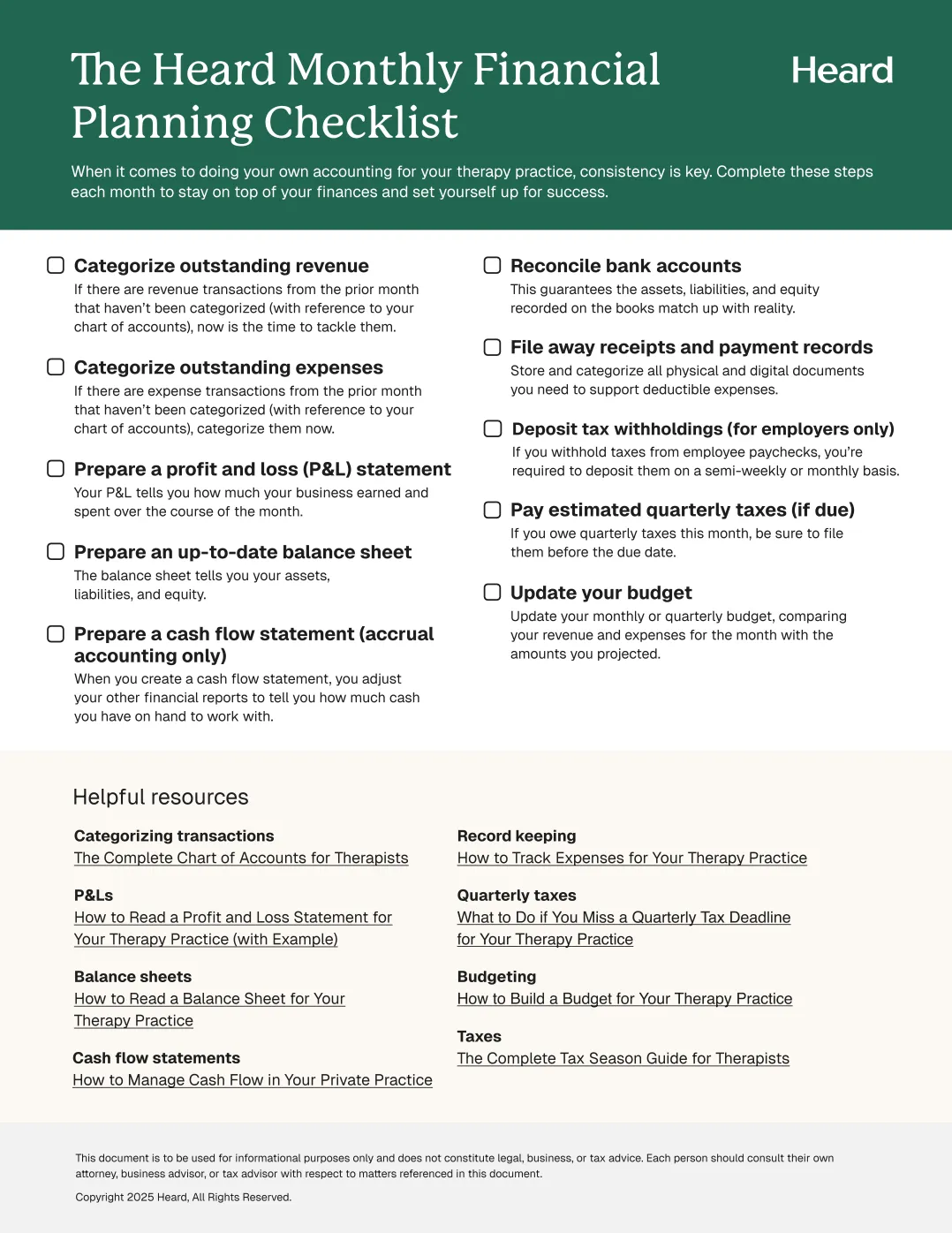

{{resource}}

Follow a financial allocation plan

Here's a straight up truth: running your own business built from the ground up is tough. Figuring out how much you should be spending for business activities like marketing, administration, and customer support can be difficult.

Allocating your budget so that you are contributing a certain percentage of money depending on the activity is a great way to stay on top of managing the finances of your private practice.

If you're a customer of Heard, you can even access your very own target allocation plan within our platform. Check it out in the Heard Portal underneath the Reports section!

Eliminate debt as soon as possible

One of the toughest obstacles for professional therapists is paying back their student loans from years of education. This barrier, compounded with perhaps needing to take on additional loans for starting your own private practice, is a challenging hole to dig out of. The sooner you can escape indebtedness, the sooner you can begin to focus on devoting more resources into business activities critical for your private practice to succeed.

Not to mention, the sooner you pay off the loans, the less interest the loan will incur overtime, which means you keep more money in your wallet. However, while attempting to pay back as much of your debt as quickly as possible is ideally what one should strive for, limiting factors and barriers can absolutely prevent you from the quickest route to getting out of debt.

If overcoming debt is a limiting factor for you, we recommend checking out some of the following for strategies you can undertake:

- How to Pay Off Student Loans Fast

- 8 Tips for Paying Off Student Loans Fast

- 5 Ways to Pay Off Your Student Loans Faster

{{resource}}

Leverage your network for help

While we don’t recommend overusing your network of friends, partners, and peers, seeking out assistance from individuals who are familiar with you and your practice operations can be an effective way to overcome a hefty financial expenditure and continue to build a private practice.

Perhaps your best friend’s sister is a business lawyer who, if you ask nicely, can help you with some legal questions. Maybe your partner is a successful entrepreneur who can help advise you on new business opportunities. Potentially you could even try to exchange services with peers who specialize in different fields. The possibilities here are limitless, especially if you happen to be a social butterfly.

Don’t be afraid to spend money to make money

In order for your business to make money, you need to spend money. We recently sat down with Dr. Andrea Zorbas of Therapy Now SF, a clinical advisor to Heard who is well-versed in the ups and downs of starting, running and building your own private practice. A tip she gave new private practices was to invest as much as they can in their marketing efforts to build up a client base as soon as possible.

With an established client base, you can then generate more income than before to further fuel your business operations. We recommend speaking to a legal or business advisor to ensure you are spending resources in areas that offer the highest potential for return.

These are just a few ways you can begin to set yourself up for success in the therapy or counseling field, whether you are becoming a private practice therapist, starting a private practice yourself, or building upon your therapy practice. If you have any questions or concerns about obstacles for achieving financial freedom, reach out to the Heard team or speak to a business professional.

—

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

{{cta}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.