When starting and building your private practice, it's common to shell out money on various expenses, ranging from new furniture, employee salaries, software subscriptions, or even parking passes.

All of these purchases involve cash flowing out of your business.

At the same time, as a therapist, you are also generating cash flow into your business by rendering mental health services to clients.

This cash movement is called your net cash flow and can be either positive or negative depending on whether you have more cash flowing in or out of your business.

Cash flows are divided into three distinct categories.

{{consult}}

Investing cash flow activities

This is cash flow generated from an investment related to your business. This may be the tangible purchase of a couch or desk, or the sale of a stock or security.

As a private practice therapist, you will likely focus primarily on the purchase of physical goods.

Operating cash flow activities

This is cash flow generated from any daily business activity, including the cost of your daily practice utilities and income from clients.

Financing cash flow activities

Cash flows between a company and its investors whether in raising capital or the distribution of dividends (this cash flow activity will be minimal in a private practice business).

Operating and investing activities will likely play the largest role in your private practice.

It can be easy to confuse cash flow with profit. After all, they both have to do with cash moving in and out of your company, accounting for any costs of doing business. However, the concepts are very different. While cash flow accounts for the total amount of money flowing in and out of your business, profit indicates how much money is left after subtracting out all expenses.

With cash flow, your private practice can be generating a positive flow of cash into the company, yet you might still not be turning a profit. This is common with new companies and small practices. With positive net cash flow, your practice will likely be able to keep expanding as you can invest more money into activities that will help grow and scale your business.

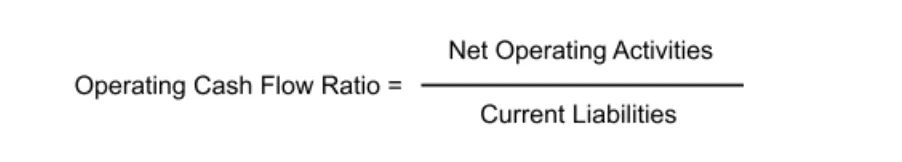

Operating cash flow ratio

If you're a math aficionado and want to check how your current cash flow is looking, we recommend using the net operating cash flow ratio, which should give you a solid estimate on the daily operations of your private practice.

Current liabilities, as referenced above, refer to any payments that need to be made for your business or private practice within one year. This can include office rent, rental equipment, short-term debt (such as a line of credit), or any bills for goods and services.

Once calculated, a good operating cash flow ratio should hover around 1. Depending on your business, this ratio could be less than 1 if your business is undergoing significant growth or extraordinary circumstances. If the ratio is less than 1, it likely means much of your cash is being generated from the financing and investing activities, which does not signal long term success for your private practice.

A solid understanding of cash flow is a must for any private practice owner or therapist growing their small business. As your client list grows, so will your operating expenses.

Keeping track of your cash flow ratio is a great way to ensure that you have a good understanding of the money moving in and out of your business.

—

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

{{resource}}

Manage your bookkeeping, taxes, and payroll—all in one place.

Discover more. Get our newsletter.

Get free articles, guides, and tools developed by our experts to help you understand and manage your private practice finances.

Heard sends you a detailed report containing your profit and loss for the prior month. Book a free consult to learn more.

Schedule a free consult