Your chart of accounts lists all of the accounts you use to label entries in your general ledger. You can think of these accounts as bookkeeping categories, or labels for each transaction you record.

Every time your therapy practice earns revenue, it’s entered in the general ledger. Every time it spends money, it’s entered in the general ledger.

By using the accounts listed in your chart of accounts to categorize these transactions, you can track how your practice earns and spends money.

{{resource}}

Categories in your chart of accounts

Every account listed in your chart fits into one of the following five categories:

| Account Category |

What it Describes |

Financial Statement |

| Assets |

Items of cash value (including actual cash!) your practice owns |

Balance sheet |

| Liabilities |

Debts your practice owes |

Balance sheet |

| Equity |

Money invested or re-invested in your practice |

Balance sheet |

| Income |

Money your practice earns |

P&L statement |

| Expenses |

Money your practice spends |

P&L statement |

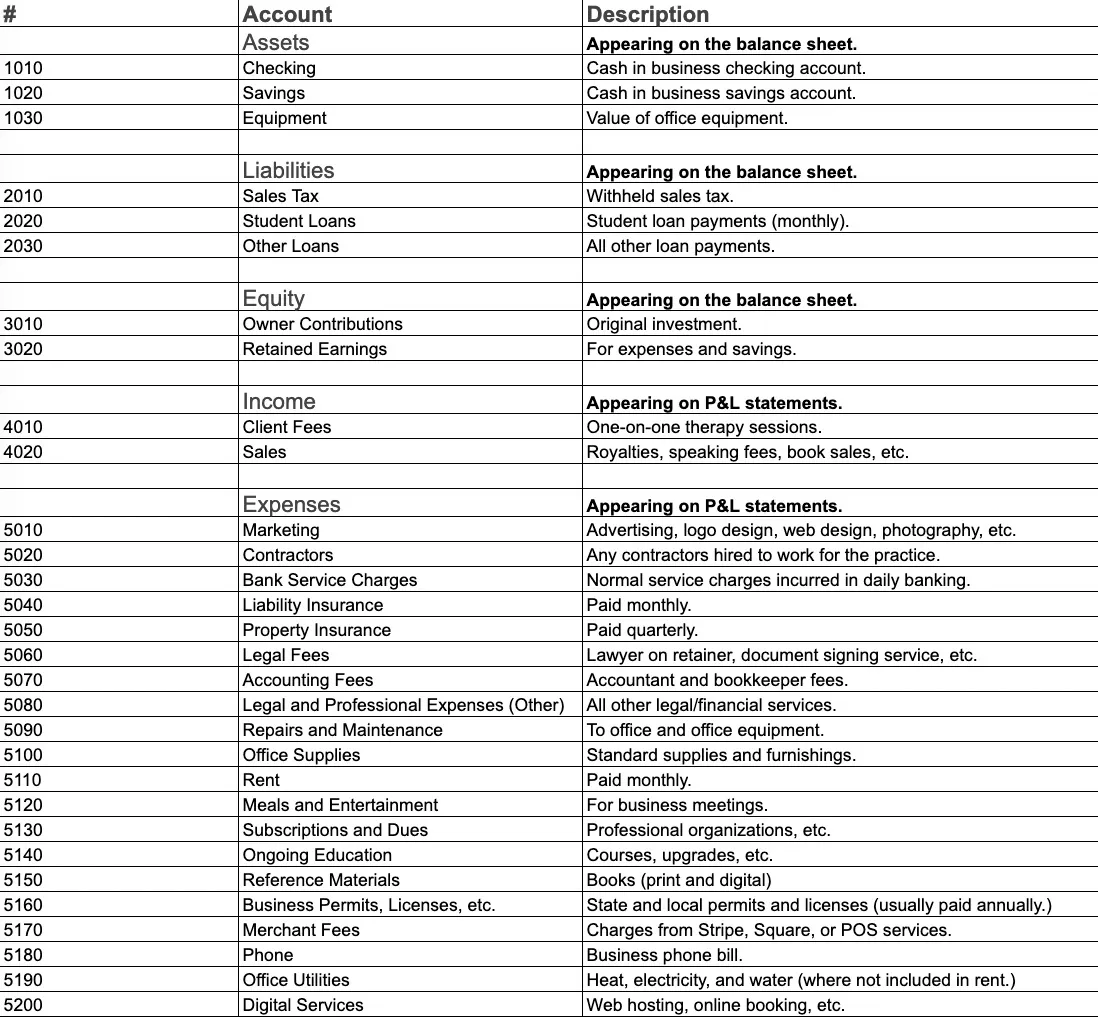

The chart of accounts

Heard is the financial back-office for therapists in private practice.

After working with thousands of therapy practices, we’ve created the complete chart of account for therapists.

You can adapt this chart to your own needs by adding or removing categories. If you do, we’d love to hear about your experience—your feedback helps us develop even more useful tools for therapists. Feel free to drop us a line.

The complete chart of accounts for therapists

| #* |

Account |

Description |

|

Assets |

Appearing on the balance sheet |

| 1010 |

Checking |

Cash in business checking account |

| 1020 |

Savings |

Cash in business savings account |

| 1030 |

Equipment |

Value of office equipment |

| 2040 |

Credit Cards |

Outstanding credit card debt |

| #* |

Account |

Description |

|

Liabilities |

Appearing on the balance sheet |

| 2010 |

Sales Tax |

Withheld sales tax |

| 2020 |

Student Loans |

Student loan payments (monthly) |

| 2030 |

Other Loans |

All other loan payments |

| 2040 |

Credit Cards |

Outstanding credit card debt |

| #* |

Account |

Description |

|

Equity |

Appearing on the balance sheet |

| 3010 |

Owner Contributions |

Original investment or business loan |

| 3020 |

Retained Earnings |

For expenses and savings |

| #* |

Account |

Description |

|

Income |

Appearing on P&L statements |

| 4010 |

Client Fees |

One-on-one therapy sessions |

| 4020 |

Sales |

Writing, speaking, research, teaching and training, coaching and consulting, dividends, interest |

| #* |

Account |

Description |

|

Expenses |

Appearing on P&L statements |

| 5010 |

Marketing |

Advertising, logo design, web design, photography, sponsorships, etc. |

| 5020 |

Contractors |

Any contractors hired to work for the practice |

| 5030 |

Bank Service Charges |

Normal service charges incurred in daily banking |

| 5040 |

Liability Insurance |

Paid monthly |

| 5050 |

Property Insurance |

Paid quarterly |

| 5060 |

Legal Fees |

Lawyer on retainer, document signing service, etc. |

| 5070 |

Accounting Fees |

Accountant and bookkeeper fees |

| 5080 |

Legal and Professional Expenses (Other) |

All other legal/financial services |

| 5090 |

Repairs and Maintenance |

To office and office equipment |

| #* |

Account |

Description |

|

Expenses (Continued) |

Appearing on P&L statements |

| 5100 |

Office Supplies |

Standard supplies and furnishings |

| 5110 |

Rent |

Paid monthly |

| 5120 |

Meals and Entertainment |

For business meetings |

| 5130 |

Subscriptions and Dues |

Professional organizations, etc. |

| 5140 |

Ongoing Education |

Courses, upgrades, etc. |

| 5150 |

Reference Materials |

Books (print and digital) |

| 5160 |

Business Permits, Licenses, etc. |

State and local permits and licenses (usually paid annually) |

| 5170 |

Merchant Fees |

Charges from Stripe, Square, or POS services |

| 5180 |

Phone |

Business phone bill |

| 5190 |

Office Utilities |

Heat, electricity, and water (where not included in rent) |

| 5200 |

Digital Services |

Web hosting, online booking, etc. |

| 5210 |

Vehicle |

Gas and fuel, vehicle loan and loan interest, vehicle repairs, vehicle insurance, vehicle lease, wash and road services, vehicle registration, etc. |

| 5220 |

Travel |

Hotel costs, rental car expenses, transportation costs, parking and tolls |

* Account numbers are used by bookkeepers to more easily track accounts.

—

Trying to set up a chart of accounts? Read our article on how to set up a chart of accounts for your therapy practice.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult their own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Bryce Warnes is a West Coast writer specializing in small business finances.

{{cta}}